What's My Rate?

Today, we want to help shed light on the number one question clients ask and want to know before they apply for business funding: “What’s my rate?”

The first thing you need to understand, especially when dealing with alternative funding programs or providers that are not your traditional bank, is that most of the programs are a fixed cost of capital instead of a compounding interest rate like you would normally expect with your credit card, mortgage or auto loan. This is important to you as the business owner because you will know exactly what the cost is going to be upfront. This allows you to make a truly educated decision on if the funding is going to make sense and if your business is going to benefit as a result. Interest rates are also designed for longer term programs to express an annualized cost of capital. Most non-bank programs offer terms less than 18 months so a traditional interest rate is not really applicable to those type of programs.

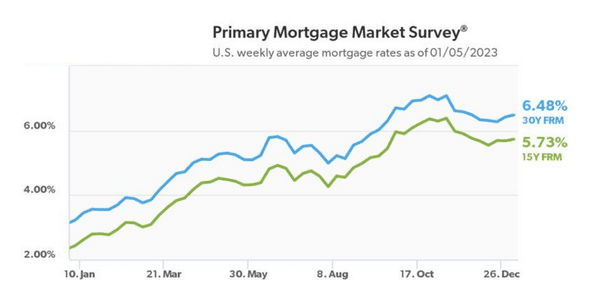

The second thing you should be aware of is the overall macroeconomic environment that we are currently in, especially related to business financing. It’s no secret that we are in a rising rate environment and the cost of financing anything is significantly higher today than it was 12 or 18 months ago. Let’s use mortgage rates as an example, here is a chart that shows the average mortgage rate in the US by week since January of 2022.

As you can see rates have gone from between 2.5% and 3% in January of 2022 to 6.5% to 7% in January of 2023 and the indication is rates will continue to increase from here. While mortgage rates are like comparing apples and oranges to business funding, the overall concept of costs increasing remains the same.

The one thing that every business owner should know is that rising rates on traditional banking products does not necessarily mean that you should expect higher costs with alternative products. In fact, while costs on almost every traditional program has more than doubled over the past 18 months, the alternative market has remained fairly consistent. When most people think alternative funding they think that means higher rates, and while in some cases that is true, in today’s environment traditional program costs are falling in line with what we are seeing on the alternative funding side. This dynamic is leading to more and more business owners turning to the non-bank financing programs due to the benefits and speed that comes along with it.

Lastly, make sure you apply for funding and go into the process with the right expectations. If you are applying thinking you are going to take $100,000 and pay 5% or $5,000 in cost over a 12 month period of time do yourself a favor and don’t apply for any program for at least the next 24 months. It doesn’t exist so don’t get your hopes up or set unrealistic expectations for what the terms are going to look like. Now isn’t the time to apply for rainy day money. If you are going to take on additional funds for your business, make sure you have a defined use of capital and know how that money will benefit your business. There are going to be some amazing growth opportunities for many business owners in 2023 and having additional capital on hand will be critical. You need to know what your ROI is going to be, how much you stand to make/benefit from the investment, and then weigh that against your cost of capital. If the return is more than whatever the cost of capital is, then likely you have made a wise choice.

If you have reached this point in the blog, thank you for taking the time to read this far. We hope that this information helps put you in a better position to select the right financing option for your business.

If you are ready to take the first step or have questions related to anything in this email, just let me know. We are here as a resource whether we end up doing business together or not (We hope we do).

This content is for educational or informational purposes only and should not be taken as legal or financial advice. The information in this content does not necessarily reflect the views of Coast Funding Services LLC or its partners.